biometric sim card

A case was registered by a victim residing in Dehradun, as Senior Superintendent of Police (STF), Mr. Navneet Singh, revealed. Nagpur Scandal Unearthed: Biometric Data Misuse Exposed by Uttarakhand STF The victim came across an advertisement for an online trading business on Telegram, which led them to join an unknown WhatsApp group. Subsequently, the complainant was instructed to join an investment group through another link, where group members shared screenshots.

The complainant was deceived into transferring around Rs 23 lakh to various bank accounts provided by the accused via WhatsApp, supposedly for online trading investments. In light of the severity of the case, the Senior Superintendent of Police (STF) instructed Additional SP Chandra Mohan Singh to lead the investigation. Inspector Devendra Nabiyal was assigned the case under the supervision of officer Ankush Mishra, who formed a team to conduct a preliminary analysis.

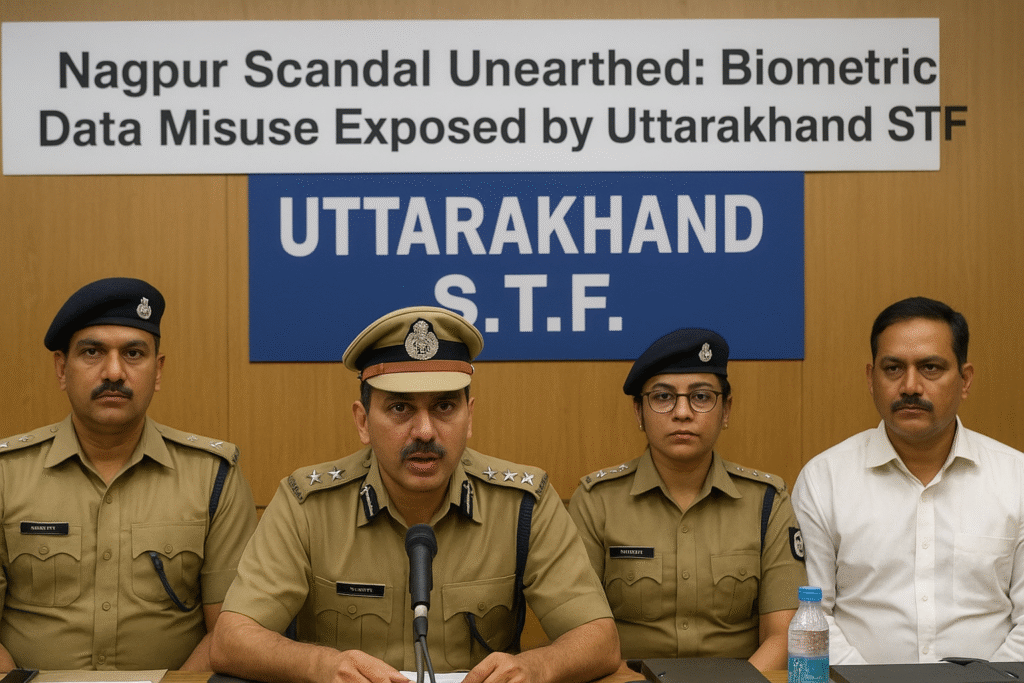

The Nagpur Scandal was recently uncovered by the Uttarakhand Special Task Force (STF), revealing the misuse of biometric data. The complainant was directed to join an investment group through a provided link, where members shared screenshots of their purported profit amounts. This group claimed to engage in buying and selling stocks in the online market. To investigate the case, the cybercrime police gathered data from relevant banks, service providers, and companies like Meta, focusing on bank accounts, registered mobile numbers, and WhatsApp numbers linked to the crime. Data analysis exposed the use of commission-based accounts belonging to unsuspecting individuals to receive the defrauded money.

In Dehradun national scam in Nagpur by online treding through WhatsApp. using biometric data.

Dehradun Resident Duped of ₹23 Lakh in Nationwide WhatsApp Trading Scam Tied to Nagpur Biometric Data Scandal

Dehradun, August 17, 2025 — A shocking cybercrime case has emerged from Dehradun, where a local resident was duped of ₹23 lakh in a sophisticated online trading scam orchestrated through social media platforms such as WhatsApp and Telegram. The incident is now being linked to a larger pan-India fraud network rooted in Nagpur, involving the misuse of biometric data and money laundering through mule accounts.

The case has raised red flags about the increasing use of encrypted messaging platforms for financial frauds, and how unsuspecting individuals are being targeted by online criminals masquerading as legitimate traders and investment advisors.

The Deception Begins: Telegram to WhatsApp

According to information released by Senior Superintendent of Police (Special Task Force, Uttarakhand), Navneet Singh, the victim first came across a Telegram advertisement promoting a high-return online trading business. The victim, intrigued by the promise of quick profits, followed the advertisement link, which led to a WhatsApp group filled with seemingly real investors. In this group, members frequently posted screenshots of their trading profits, showcasing daily returns and positive experiences.

These images, later found to be fabricated or manipulated, were used to build trust and draw new individuals deeper into the scam.Later, the complainant was asked to join another exclusive WhatsApp group via a link, allegedly for “premium investors.” Within this group, more success stories were shared, and members claimed to be involved in stock trading and crypto investments. It was here that the victim was first approached privately by individuals posing as “financial consultants.”

These consultants directed the complainant to invest in certain “high-potential” trades, and shared multiple bank account details to which the victim was asked to transfer funds. Over several weeks, the victim transferred a total of approximately ₹23 lakh in multiple transactions, believing they were being used for profitable investments. However, when the victim tried to withdraw profits or recover the initial capital, all communication from the group admins ceased. The WhatsApp groups were deleted, and the numbers became unreachable.

STF Launches Full-Scale Investigation

Shocked by the sudden disappearance of the so-called advisors and the loss of such a large sum, the complainant approached the Uttarakhand Special Task Force (STF). SSP Navneet Singh took immediate cognizance of the case and assigned Additional SP Chandra Mohan Singh to oversee the investigation. A case was formally registered, and a dedicated team led by Inspector Devendra Nabiyal, under the supervision of Officer Ankush Mishra, began digging into the digital trail.

The STF quickly realized that this was not an isolated incident. The pattern of deception—Telegram advertisements, WhatsApp investment groups, fake screenshots, and the use of multiple bank accounts—indicated a larger organized cybercrime syndicate.

The Nagpur Connection: National-Level Biometric Fraud

As the investigation deepened, the STF discovered links to a broader scam recently uncovered in Nagpur, Maharashtra. Dubbed the “Nagpur Scam”, this nationwide racket involves cybercriminals misusing biometric data — such as Aadhaar-linked fingerprints or iris scans — to create or operate bank accounts without the knowledge of the actual account holders.Many of the bank accounts used to receive the ₹23 lakh were found to belong to ordinary citizens, most of whom were unaware that their names or accounts were being used.

These are called “mule accounts”, and are often created using stolen or spoofed identity documents. In some cases, individuals were lured into giving up their biometric data in exchange for small cash rewards.Authorities believe that a network of agents across different cities, including Nagpur, Dehradun, Delhi, and Hyderabad, are involved in collecting biometric data from rural and urban populations under the guise of job applications, SIM card registration, or government schemes.Role of Technology Companies and Financial Institutions The STF, with assistance from its cybercrime division, has requested data from various telecom operators, Meta (parent company of WhatsApp), and nationalized/private banks.

Investigators are analyzing call detail records, chat logs, IP addresses, and transaction histories to trace the origin of the fraudulent WhatsApp groups and identify the masterminds behind the scam.An officer involved in the probe stated that the fraudsters likely used virtual private networks (VPNs), international SIM cards, and cloud-based communication tools to mask their identities and locations.

Additionally, the end-to-end encryption on WhatsApp has made it difficult to track conversations unless supported by forensic tools or company cooperation. Banks are also under scrutiny for allowing large transactions to flow through newly opened or dormant accounts, sometimes without proper verification. A senior cybersecurity expert noted, “The misuse of biometric data shows a serious loophole in our KYC and identity verification systems.”

Public Advisory and Preventive Measures

In response to this case, the Uttarakhand Police and STF have issued an advisory to the public, warning them against joining investment groups or responding to financial offers on social media and messaging platforms.

“No genuine trading or investment platform will ask you to transfer money through WhatsApp or Telegram. Always verify with official company websites and ensure proper documentation,” said SSP Navneet Singh.

Citizens are also being advised to avoid sharing biometric data with unverified agents or websites, and to report suspicious financial activity to their local police or cybercrime portal

nice content

thanks and we always trying to do best